DeepFin

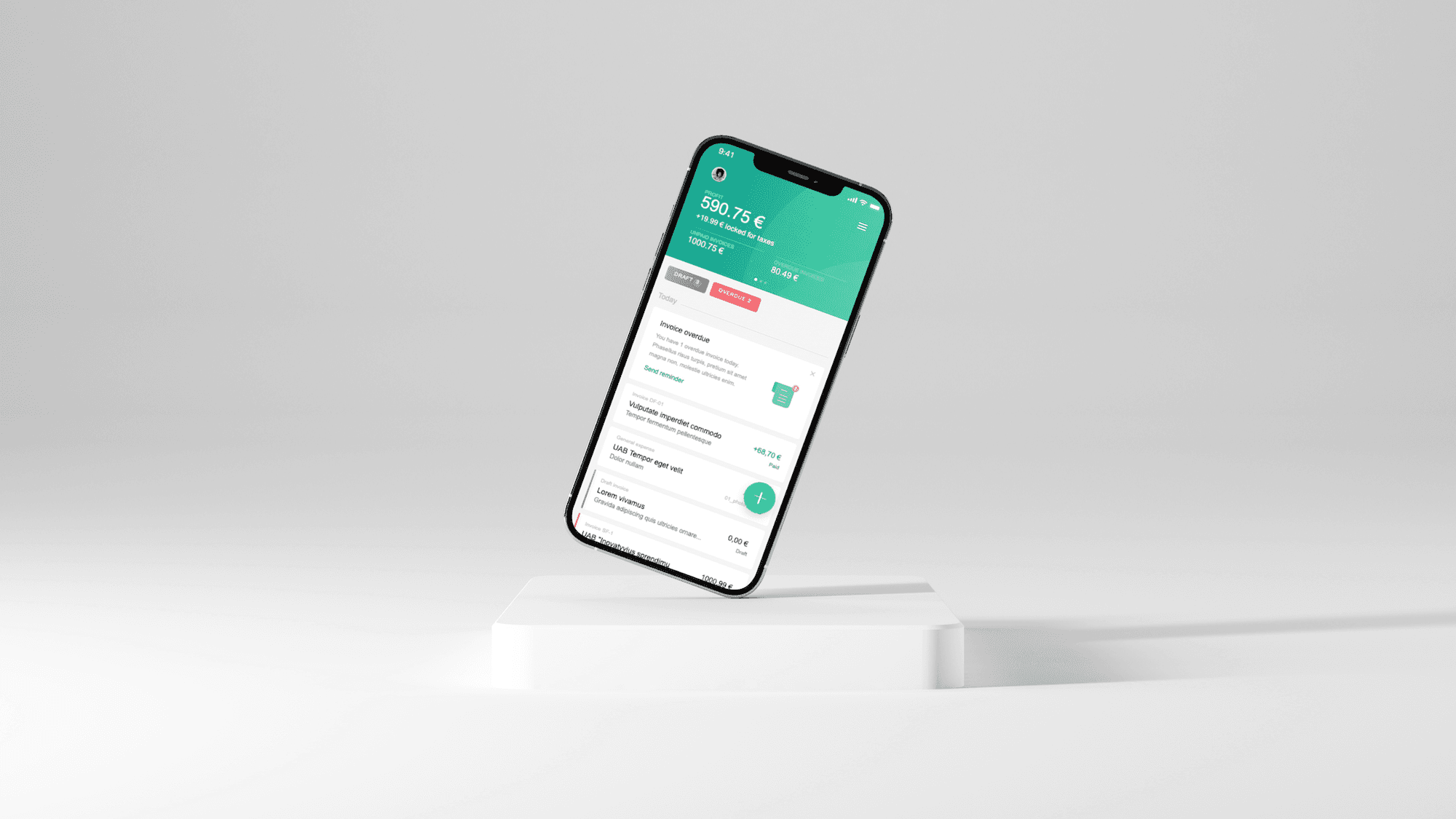

Deepfin is an essential financial assistant for freelancers that helps to monitor cash flow, get paid faster, pay taxes and solve problems.

Background story

DeepFin founders’ vision is to allow freelancers to better focus on serving their clients and customers instead of spending time doing tedious admin tasks.

Built and designed for freelancers, it allows users to easily manage personal accounting & invoicing tasks. This essential financial tool helps personal businesses to free up hundreds of hours spent on managing business finances with a simple mobile app. Deepfin acts as a financial assistant for your business to monitor cash flow, get paid faster, pay taxes - straight from your pocket.

We partnered with the DeepFin team to create an intuitive mobile app to bring their vision to life.

The Challenge

When DeepFin first approached us, they had nothing but a name, an idea and a determination to disrupt the industry.

One of our biggest challenges was making sure that we came up with the brand, design, app development build within a short time frame to make sure we hit the tight deadline. In terms of UX, we had to ensure that the process to achieve user goals is as simple as possible, especially because taxes and invoicing are generally seen as notoriously complicated, lengthy and boring to do. For us as an agency it was also very important to make sure that this was completed to an impeccably high standard.

Designing and developing a customer-centric workflow that works perfectly on all devices.

Implementing a logic of taxes and making sure it’s compliant with local law

Key Features

Create and send an invoice straight from your mobile device in less than 60 seconds. Track overdue invoices, send reminders, get paid faster.

Easy to use flow ensures a smooth creation of invoice. A user can reuse elements used before so no need to type in repetitive entries. It automatically generates an invoice number, pre-selects due and issue dates and allows you to send it to the recipient straight from the app. It uses a template email message, so the tedious work this way is kept to a minimum.

Taxes can be confusing to many people. As “Taxes” sits at the heart of DeepFin, to make the experience smooth, founders included a digital assistant.

DeepFin’s digital assistant asks simple, personalised questions, in just a few minutes, which quickly determines the tax profile for a user. This can later be amended in Settings, if necessary.

Once the tax profile is determined, the application produces an annual tax calculation. It lets you monitor your tax and social payment liabilities live. However, if a user makes changes in Tax settings, the taxes then recalculates automatically. It also takes into account already paid taxes and displays the updated information.

Freelancers know how painful it is to constantly worry about pending payments as well as overseeing taxes to be paid. DeepFin has it under control, it helps:

A user can see unpaid invoices and planned taxes, which helps users plan their expenses.

A user can see a tax estimation for the upcoming year with payment timelines.

To help users engage with their finances in a more proactive way, we implemented a number of notifications. Notifications serve as reminders to never miss deadlines and be alerted of upcoming events.

We introduced several types of notifications: timeline and push.

Top of timeline and timeline notifications

- Help users keep track of skipped information inputs such as IBAN,

- Guides users to set up their taxes (once registered), and

- Alerts of overpaid taxes (when changing tax settings i.e. tax profile)

Push notifications

- Reminds users of overdue invoices;

Security

Managing personal finance requires an additional layer of trust and security.

DeepFin lays a foundation for a trustful and secure product by introducing an instant and streamlined onboarding experience.

Authentication is based on phone number. To be able to login, a user has to use their phone. Touch ID/ Face ID adds an additional layer of security.

Since we are handling financial data and we know how sensitive it is, we handle it with extra care.

From the very beginning, it was established that we will set up DeepFin using a private cloud, so the product will be ready to scale in a secure way.

Having 2 instances allows to stabilise the traffic and provides a secure foundation for data storage, however from the technological point of view it brings a challenge to synchronize data between servers leading to having some parts to be centralized.

Upcoming features

Open banking service to allow users access their banking, transaction and other financial data from banks through rest API. This would be a major stepping stone for the product as it would let both systems communicate. Users will be able to make payments straight for the app without being redirected to a bank.

API versioning - to guarantee smooth deployment to production, we will be introducing API versioning. With API versioning, we can avoid situations when major changes in product effectively leads to production being down for several hours.